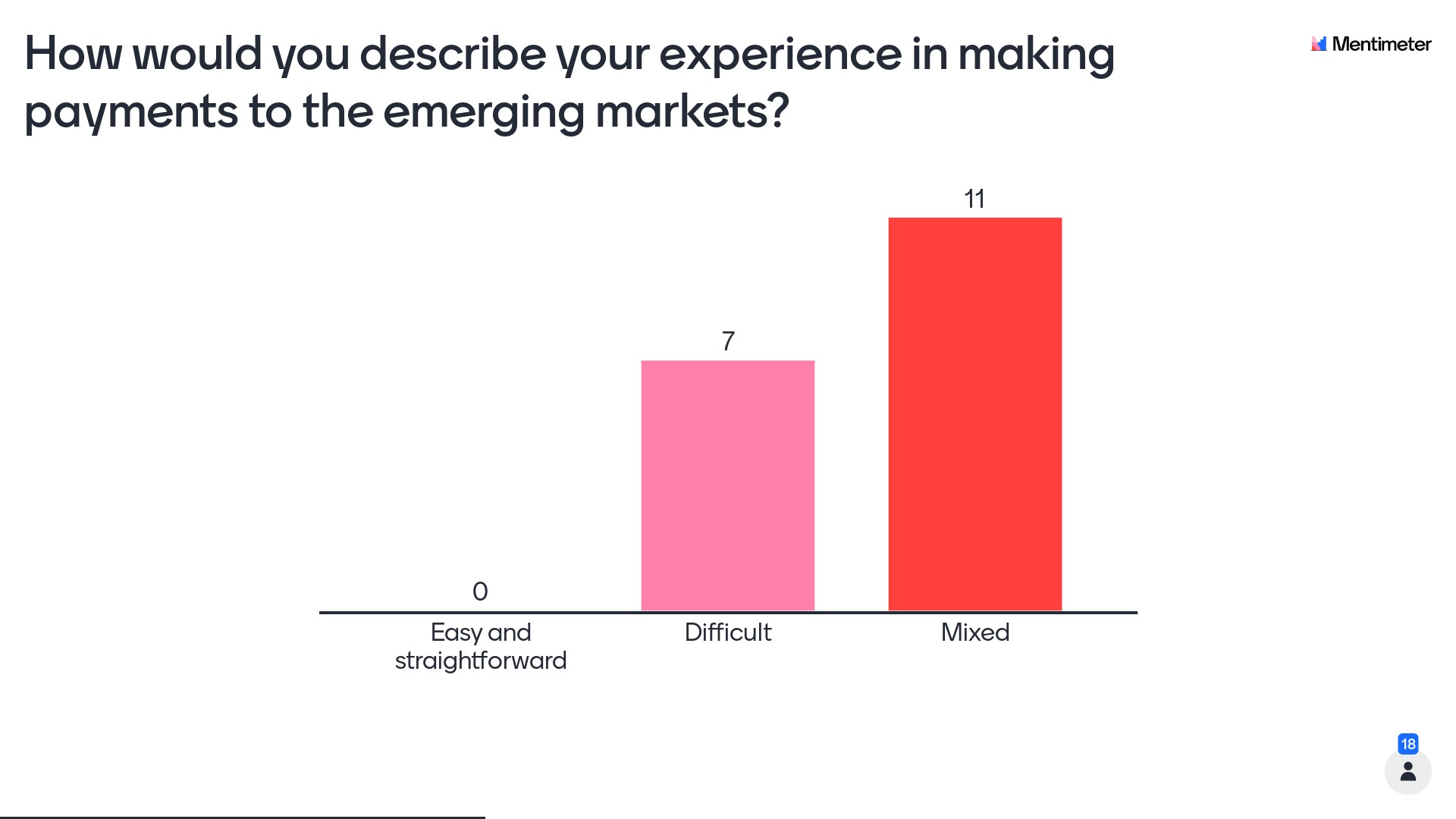

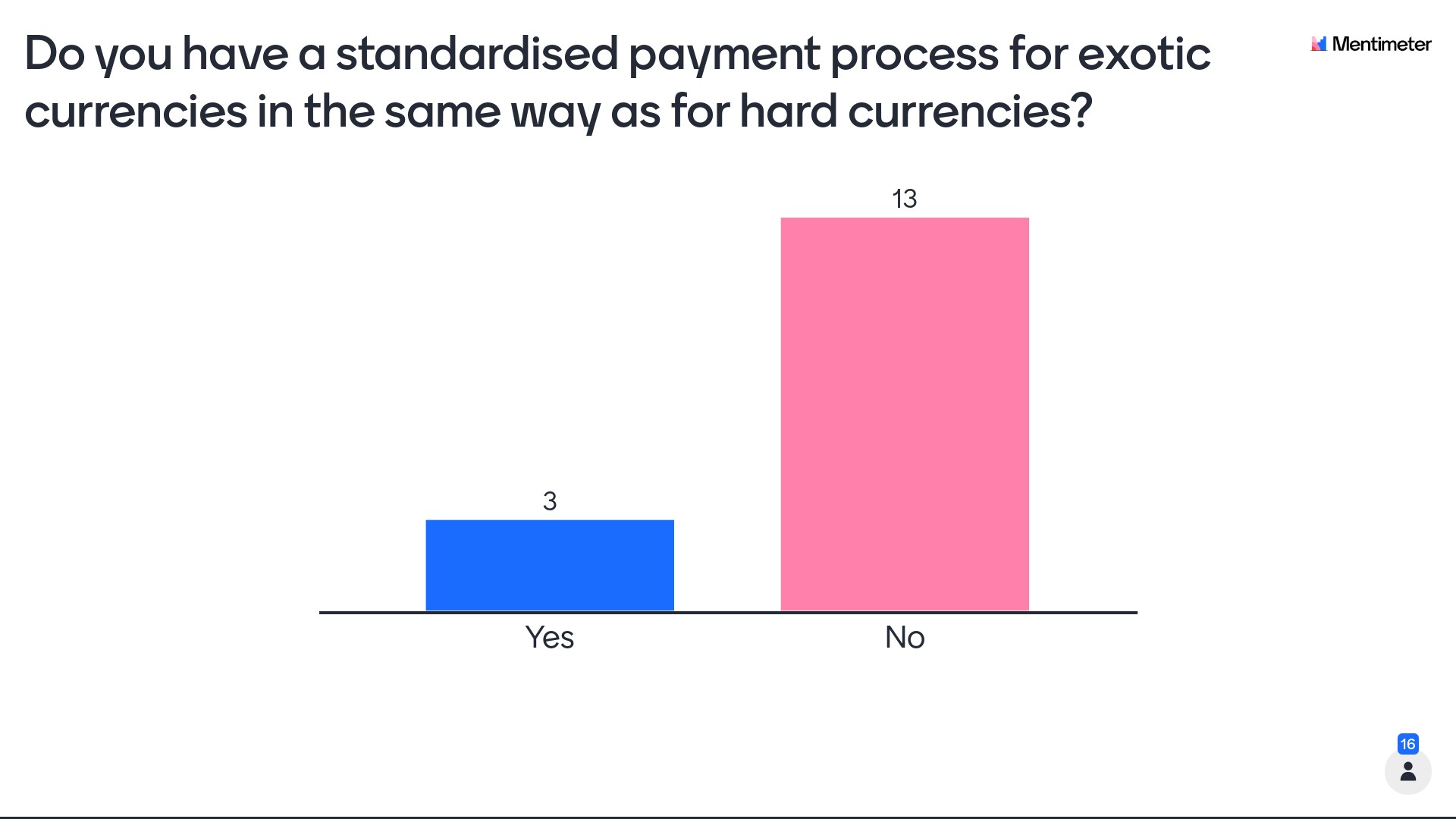

David Willacy is a foreign-exchange trader with payments/trading facilitator StoneX. The first half of his Helsinki session gave background on a pick of emerging-market currencies, and the stimulus packages that have shaped the trading environment over the last year-and-a-half. In the other half, he then went to poll the local treasurer audience about their experience of paying to emerging markets.

Here are slides showing the three questions and responses.

AD

• News from the 16 November Treasury 360° Helsinki 2021 conference is gathered here.

• Find the agenda and sponsors here.

• By the way … are we connected on LinkedIn already? Follow us here.