![]() Since the pandemic, Treasurers focus has shifted from time-consuming manual workflow to fully automating Treasury processes to improve control, increase forward-looking strategic planning and make adaption to market changes in a quick and efficient way.

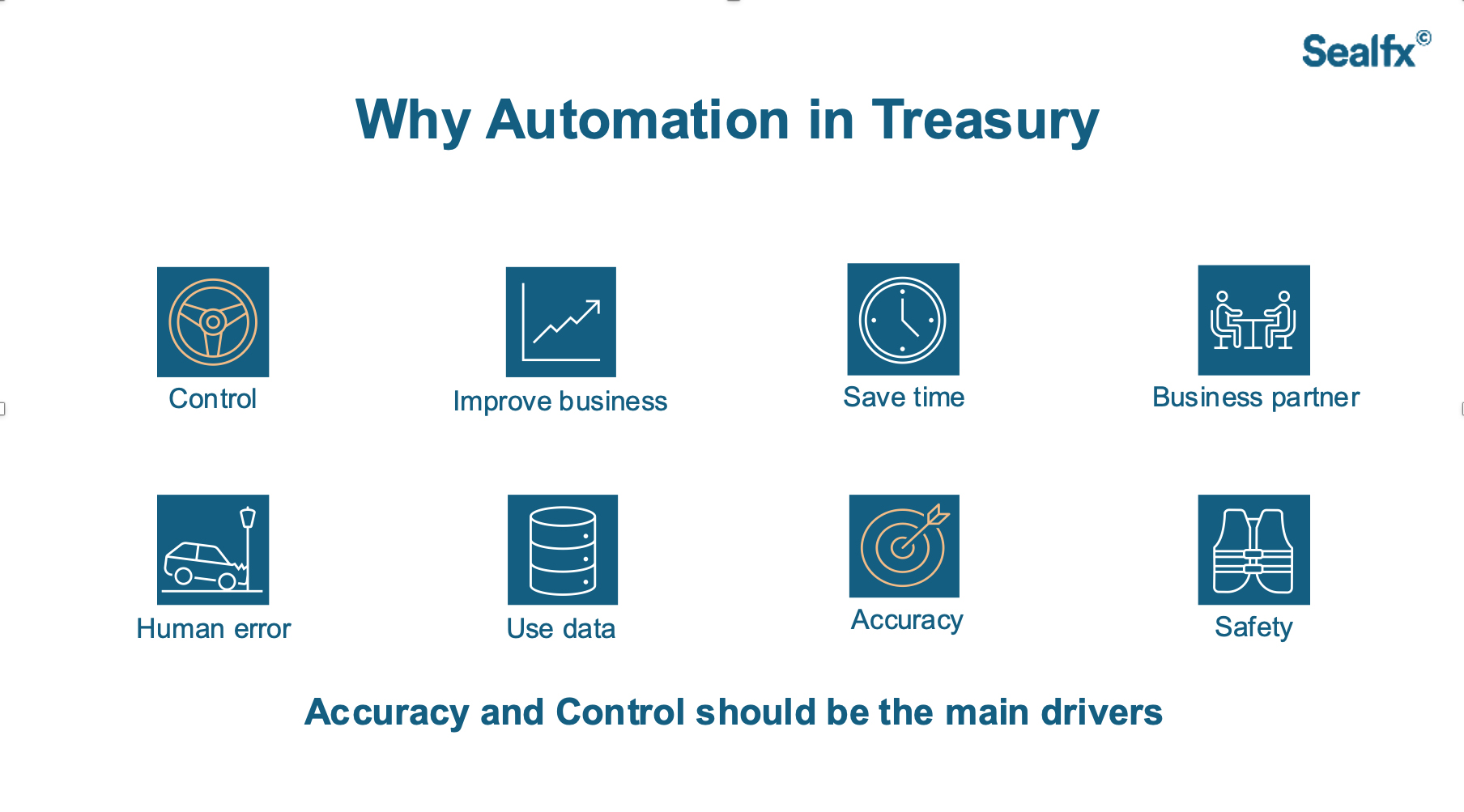

Since the pandemic, Treasurers focus has shifted from time-consuming manual workflow to fully automating Treasury processes to improve control, increase forward-looking strategic planning and make adaption to market changes in a quick and efficient way.

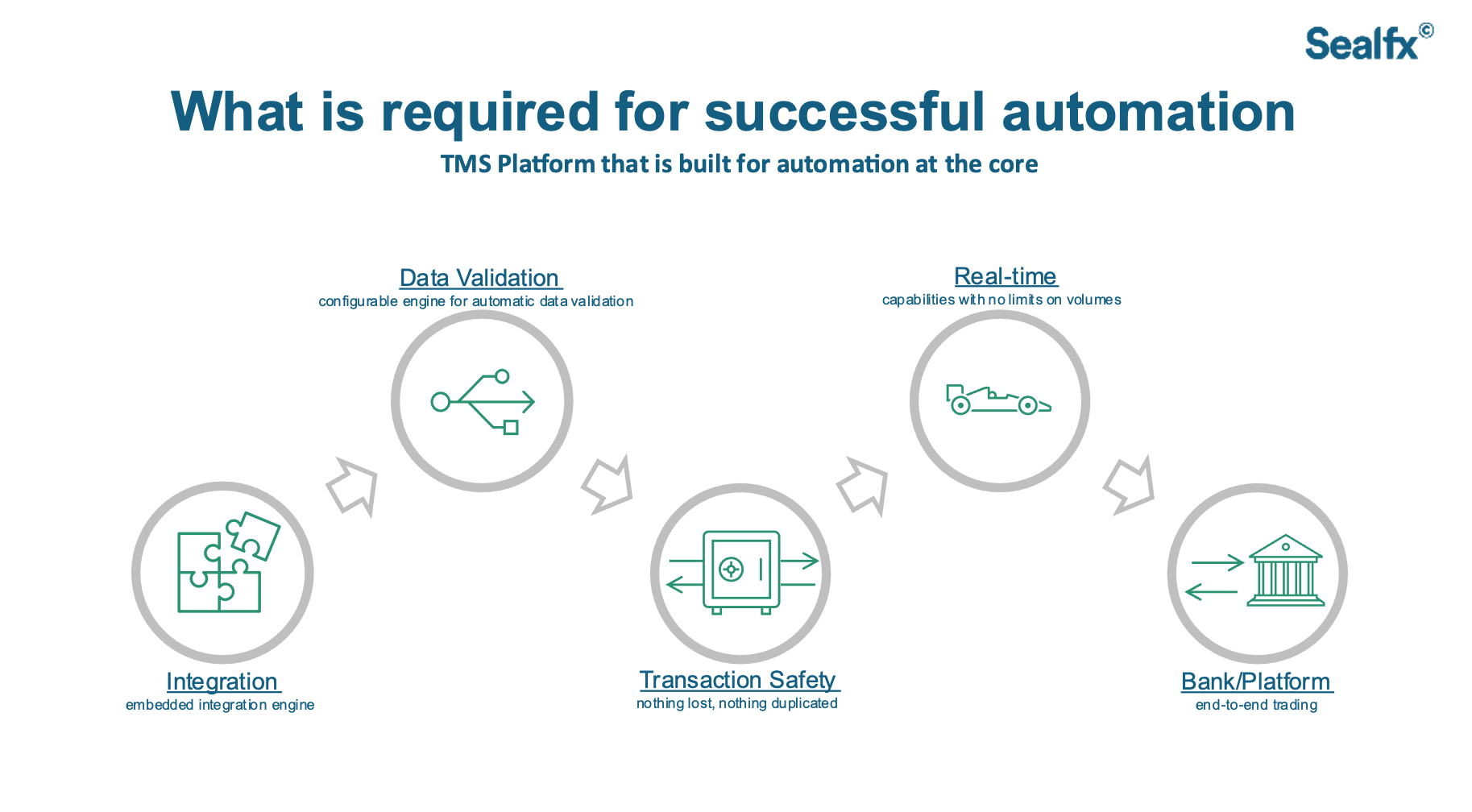

Real-time data validation is key for successful automation

Every day, large amounts of data flows through company unique systems, state-of-the-art integration engines can receive and transform this data with control and accuracy. The very foundation of a well-functioning Treasury department are Control and Accuracy. Without these two parameters – you can never leverage on other important topics such as Treasury being a business partner and helping improve the business using relevant data and saving time in the process!

Visual Control = Zero Control. Visibility of data is very important but can and should never be a guarantee for being in control! The risk of human errors in combination with bad data validation processes is history if you are adapting your processes using modern technology.

How to ensure 100% correctness of the information? The answer is through real-time automatic data validation and testing!

Validation and testing can be time-consuming for Treasuries. That is why suppliers of modern Treasury Management Systems can do most of the testing as long as business rules are clear and defined. This process is also good as a verification that the applied business rules within a Treasury department are aligned, adapted and suitable so the fulfil the demands from the business.

With all the tests being automated and run in the cloud, they are as fast as a lightning. And here comes the best part… As the software handles all the validation, the companies’ system remains lightweight and simply uses the tools available for the data transfer without a worry about transformations or formats.

With this process – you do not only improve visibility for a Treasury department – you also know that what you see is correct!

Embedded integration is key for a quick and smooth implementation

To be successful in this transformation, software solutions for seamless integration between internal and external systems and state-of-the art validation of data, are key. To be able to provide a solution for seamless integration, the integration engine of the software must be able to integrate with any type of system, vendor, or data provider. All this could be accomplished by a SaaS solution with integration at its core, that is easy to implement without developing any company unique integrations, making integrations quick, flexible, and maintainable.

Get to know us more! www.sealfx.com