Replacing the physical payment card with a digital one – a phone app – could let more employees and other collaborators have your cash at their disposal. At least a limited amount of the money – and for a limited time. The virtual card is ”pushed” to the phone’s ”wallet” by an authorised person at your company.

Presented at fintech event

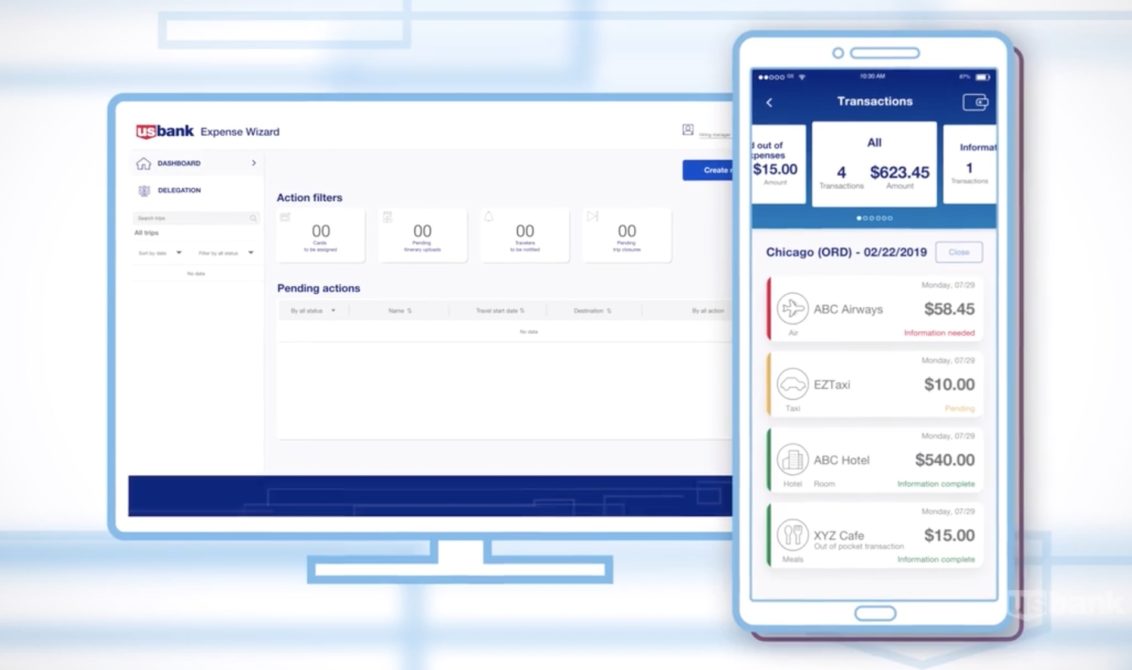

A new service featuring this logic was presented last week at fintech trade show Finovate in San Francisco. Behind it is banking giant US Bank together with Chrome River, an expense and invoice automation systems expert. The product goes by the name Expense Wizard, and a two-minute video explains how it works. Treasury news site CTM File took notice.

Data from each payment, together with comments entered by the card holder at the time of the purchase, are conveyed straight back to the corporation’s ERP system. That way, the solution is meant to let go of a great chunk of expense reporting.