You definitely can’t do it alone, that’s for sure,” says Lena Myklebust, listing some of the types of partners.

Describing Volvo Cars’ solution, Johan Larsson emphasises the ambition to be “bank-agnostic”, seeking to avoid “host-to-host” solutions. “Maybe we were a bit naive in the beginning, thinking it would be easier to plug and play than it was”, he says.

Using Swift’s “Service Bureau” has been a part of his organisation’s strategy to make itself less dependent on individual connections. “Still, I would have wished that it was a little easier to change banks,” he adds.

Integration issues around payment-on-behalf-of solutions (“Pobo”), and varying dialects of messaging formats are among the many grainy practicalities that the treasury can find itself up against upon the actual implementation.

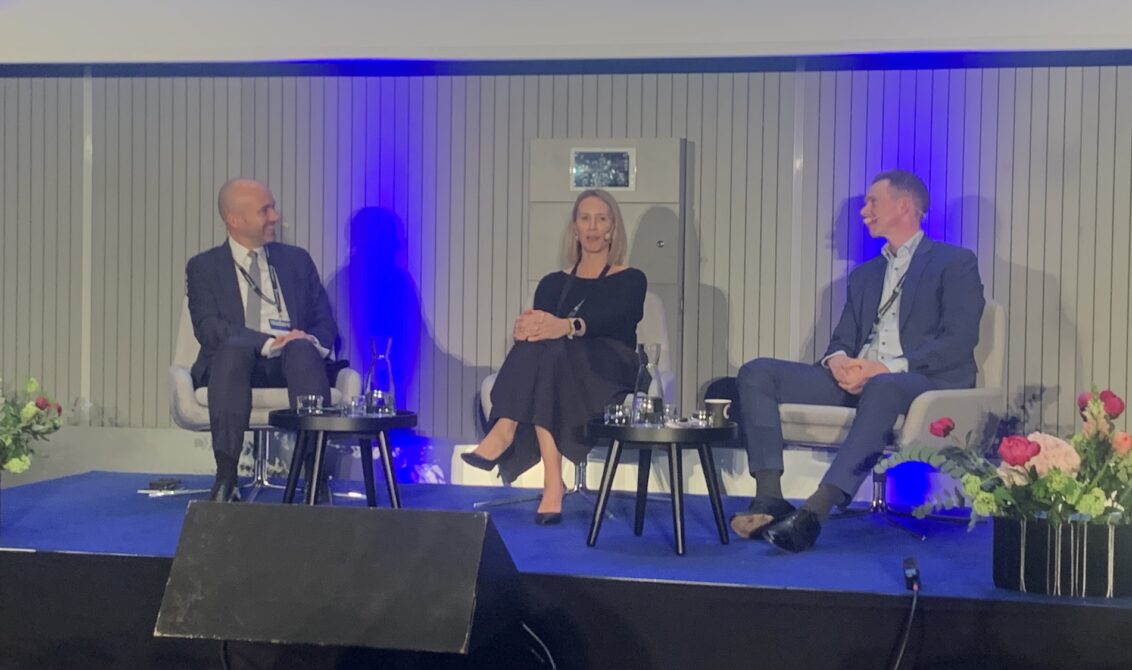

Speakers:

Lena Myklebust, Head of Cash Management Infrastructure, Equinor.

Johan Larsson, Head of Cash & Treasury Risk Management, Volvo Cars.

Moderator: Christof Hofmann, Head of Corporate Cash Management, Deutsche Bank.

• News from Treasury 360° Nordic 2024, at Copenhagen Airport on 23 May, is gathered here.

• And why not spread the posts in our LinkedIn flow? Sign up to follow it if you don’t already – and spread this post!

• Find here the main conference website, with agenda.

• Download the 68-page event magazine here (including a packed 7-page agenda section).

• Many sessions appear in full as videos in the days or weeks after the event.