Some, including investment bank Goldman Sachs, have been quick to describe the current stock market freeze as a non-threat to the finance system as a whole. Even so, many are feeling some chill as they see borrowing costs take to the sky.

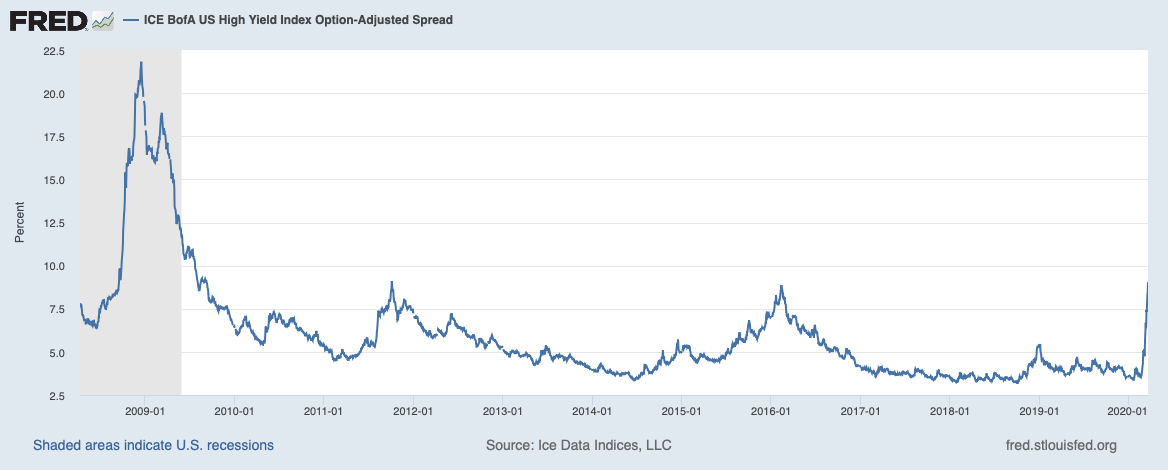

Companies below investment grade must now pay up around 9 percentage points (yes, 900 basis points) on top of treasury rates. The spike is evident in, for example, the ICE BofA US High Yield Index Option-Adjusted Spread – a collective indicator of the premium for bonds of corporations rated BB or lower. Its figure for Thursday 19 March was 9.82 percent, to compare with 3.60 at New Year. This is just above peaks in 2011 and 2016 – yet far from the extremes of the credit crisis in 2008 and 2009 when the top value was 21.8 percent.

Three-fold rise for the good ones

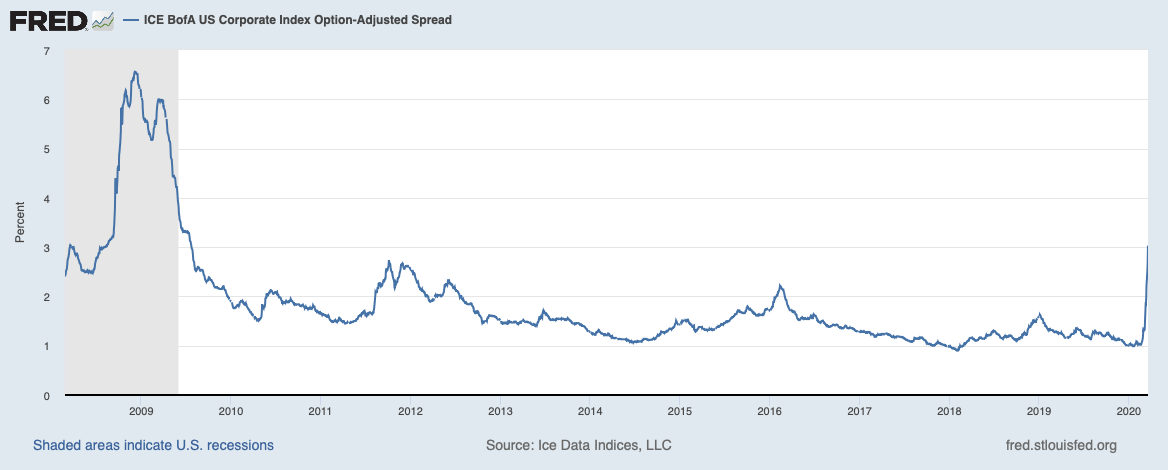

Investment-grade corporations, too, feel the cold winds blowing. The corresponding index spread for their bonds, the ICE BofA US Corporate Index Option-Adjusted Spread, reached 3.51 percent on Thursday, up from 1.01 on 31 December.

Many industries – including travel and hospitality as the extremes, but also manufacturers whose factories need to shut temporarily – are seeing their cash flows turn to trickles as restrictions against the spread of coronavirus put everyday activities on hold across the world. This, in turn, triggers fear of late payments or even defaults across supply chains, and drives risk premiums on bonds up. This applies to the full spectre of corporations, but more than anything to those with poor credit ratings in the first place.

These diagrams were generated at the website of the Federal Reserve Bank of St. Louis: