CTM File carries two newspieces relating to Mastercard. Firstly, the cards payment giant has partnered with blockchain payments company R3, to develop a cross-border payments solution. Secondly, Mastercard has presented a “vision”, a general but rather detailed plan, on how it sees the modernized payments landscape of the future.

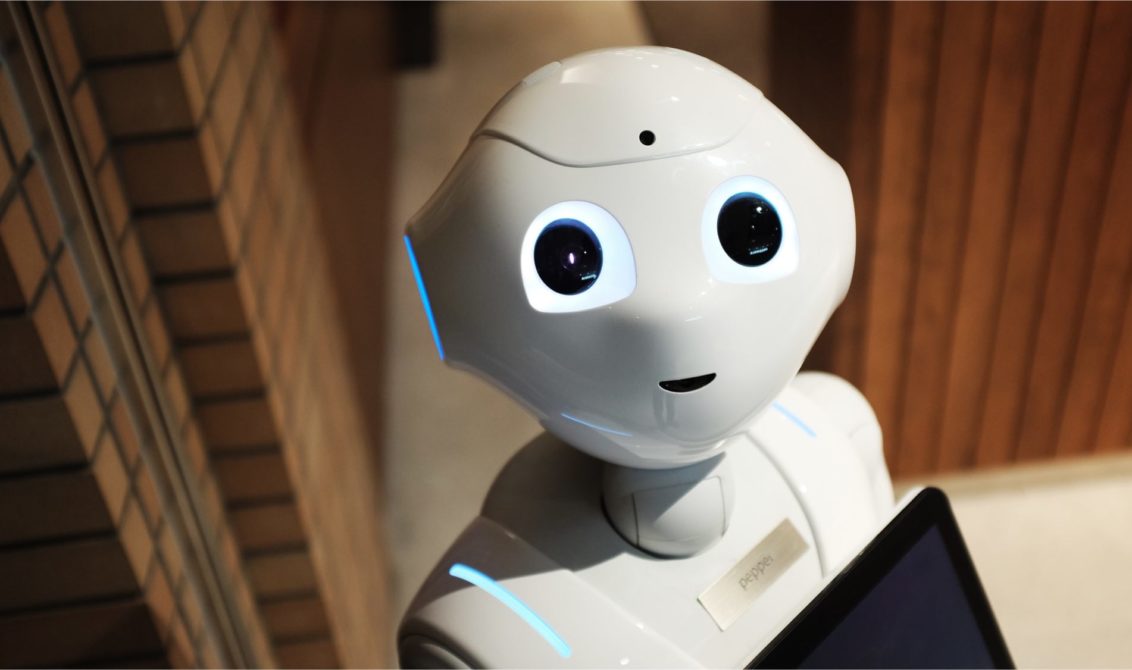

Smart assistance?

The Global Treasurer has taken a look at the prospect of heavily stepped-up automation in treasury team activities, under the thought-provoking headline “Where do robots sit in the treasury team (and what will they do)?”. In another article, contributed by an academic researcher, the site digs into the factors that corporations should consider when they embark on centralising their cash management.

Treasury Today analyses the danger of an escalation of the US-China trade conflict, and how it is already taking bites out of global growth forecasts. It also takes a close look at how standardised information sharing can provide an escape path from the hassles of KYC processing.

How to hedge when yields slope down

Last week, we looked at the rich crop of stories that Treasury & Risk had reaped from the emerging new lands of low or negative yields. In an already much-read best practice article, the publication now goes on to advise risk managers on how they should respond to this year’s inversion of the yield curve, by incorporating the new market expectations into their hedging decisions.

“For as long as the inverted yield curve persists, the consensus forecast will point to falling short-term interest rates. This change has a critical impact on the economics of hedging,” the article suggests.